Our Merchant On-Boarding Process is simple, secure and robust to ensure thorough assessment, evaluation and judgment of our prospective partner merchants for availing our services.

We have two independent teams that finalize the On-Boarding process:

1. Merchant Operations Team

2. Risk Management & Legal Affairs’ Team

These teams work independently making their own assessments and evaluations after receiving individual sets of data that is collected from the prospective Merchant.

After the individual assessments are done and a ‘Green Check’ is issued by both teams, the evaluations and assessments are then exchanged between the teams to cross check the other teams evaluation method and if

proper process was adhered to, simultaneously mitigating any probable bias and discard any ‘Objectionable Merchants’ that are either (or have in the past) carrying out business operations that do not 100% comply and adhere to the enforced laws of the land or conduct businesses that have a high degree of risk that could possibly lead to cheating or defrauding people and invariably leading to any legal disputes.

Our assessment and evaluation processes followed have been diligently drafted primarily on the guidelines and rules framed by the RBI (vide Notification DPSS.CO.PD.No.1810/02.14.008/2019-20 Dt. 17/03/2020), advice and counsel of our banking partners and renowned consultants, prevailing industry best practices and our own zeal to provide our Merchants and Customers a safe, trusted, reliable and a secure platform to allow exchange of payments all across. These assessments, evaluations and processes shall be updated from time to time as per the regulatory guidelines formulated and enforced.

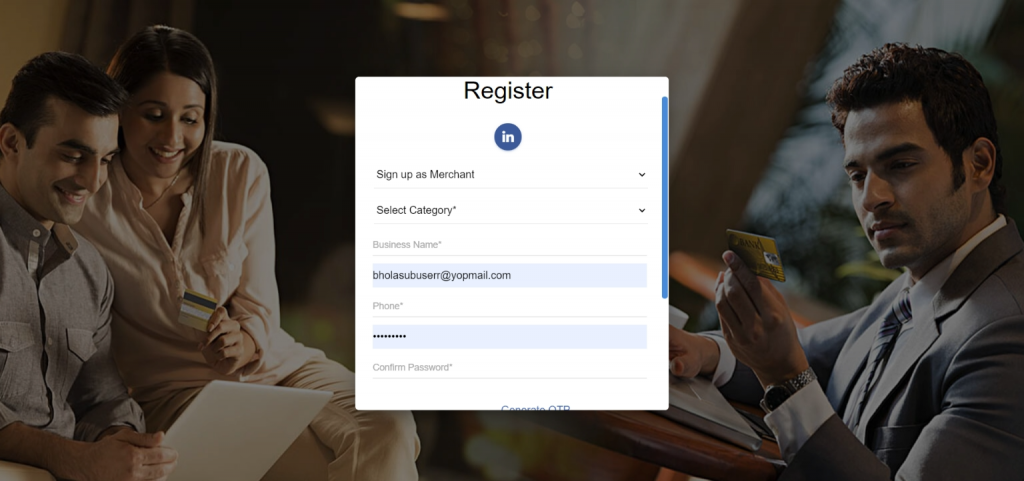

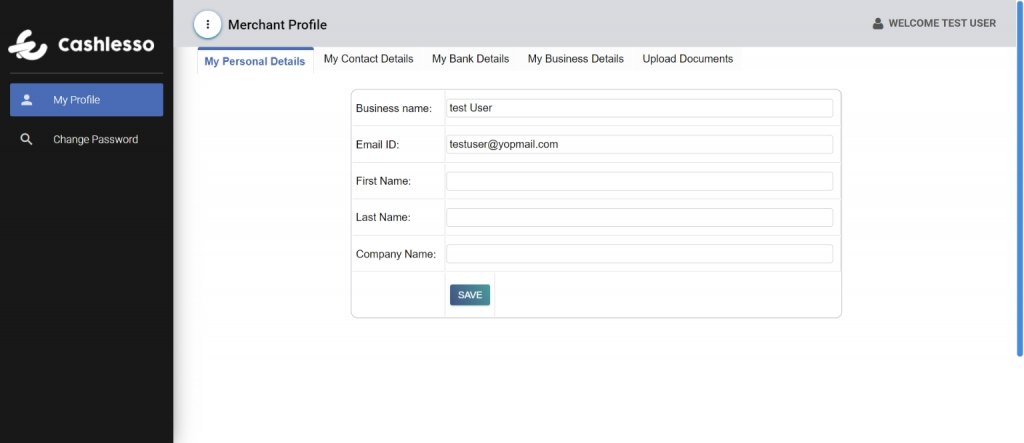

Prospective Merchants are requested to create an account on our Sign up page to receive a temporary and restricted access to our dashboard. Once the Prospective Merchant verifies the credentials through the email received, they may proceed to the next step.

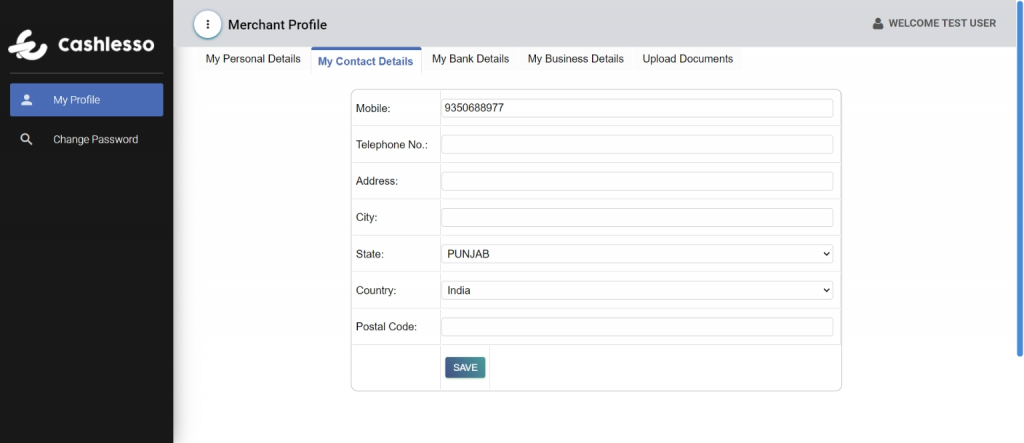

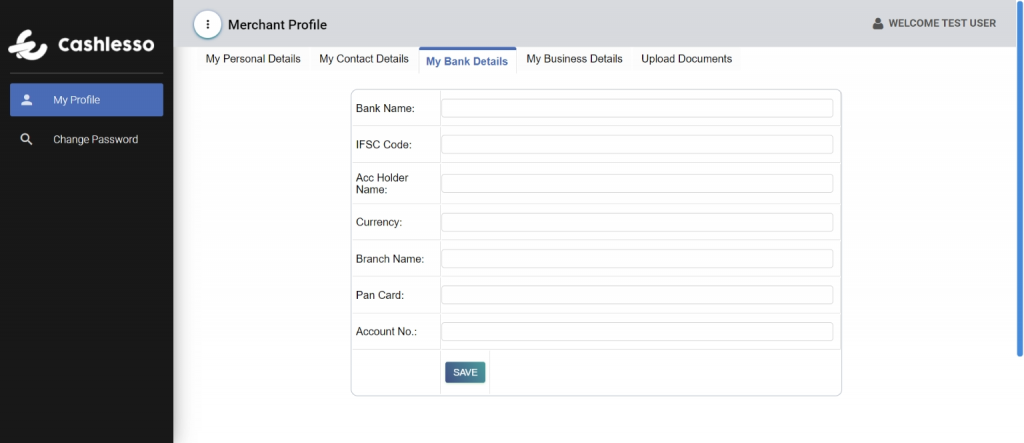

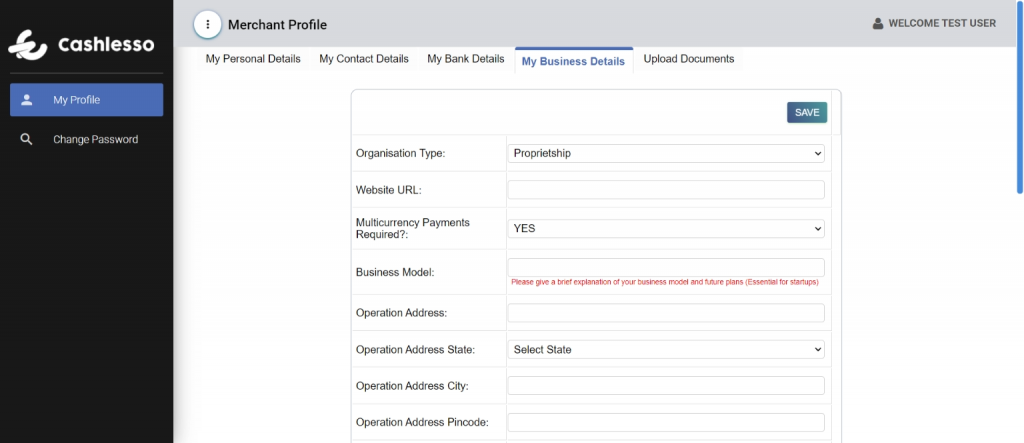

Sign-up Form; Our Merchant Registration Form is the second step in our Merchant On-Boarding Process. This form collects the basic information regarding the Prospective Merchants Business, constitution, contact details, etc. The Merchant will be able to upload the required documents to meet the KYC Process. The Prospective Merchant shall be assured that all information collected is stored on secure servers and is kept under strictest confidentiality terms.

After the Sign-up Form is processed by our team, we shall contact the Prospective Merchant via the provided contact details and complete the e-KYC formalities.

Assessment and Evaluation - Phase 2

Merchant Evaluation & Risk Assessment: A simultaneous process of evaluating and assessing the Prospective Merchant as well as a detailed risk assessment of the Prospective Merchant’s based on variety of factors including but not limited to the business details, model and functioning, shareholders and business owners, domain check, DNS Check, website evaluation and checking for ‘Restricted Business’ activities, cross checking against banking and credit authorities, etc. is undertaken to provide efficiency, remove bias and cross-verify the assessments of each team.

Further Documentation (if Needed): Additional documentation and clarifications if required are sought from the prospective partner merchant.

Interim Discussions & Approval: Once the documentation has all been submitted and a preliminary check conducted with a ‘Green Check’ is received, discussions are now entered into with the Prospective Merchant seeking clarifications and concluding any discrepancies (if any). At this stage, if all goes well, an interim decision is being rendered to the Prospective Merchant in regard to the payment options being offered to the Prospective Merchant.

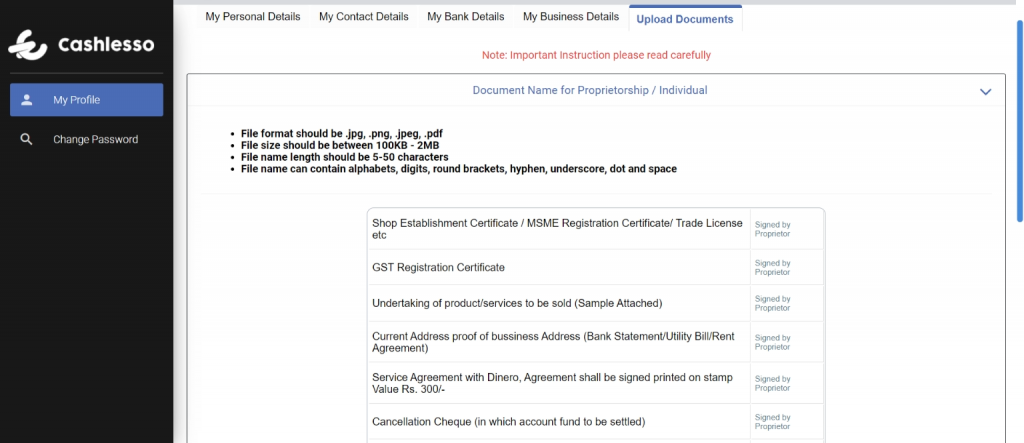

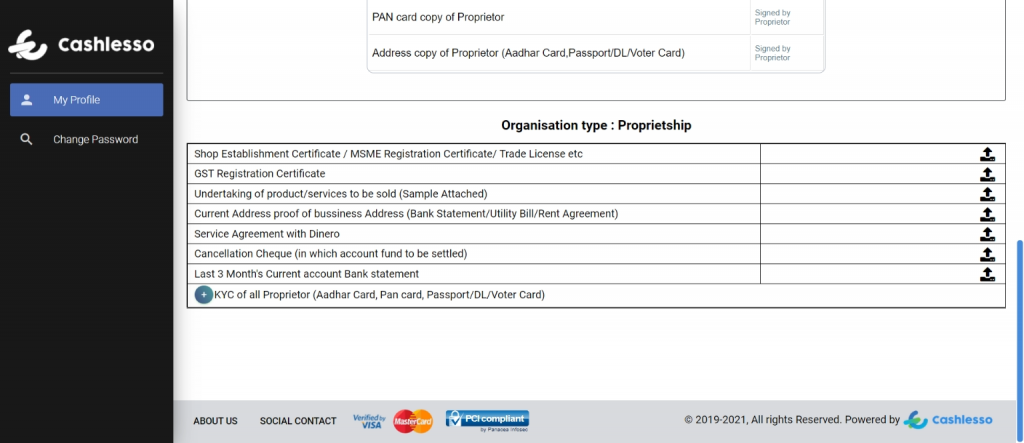

Final scrutiny and approval: Once all discussions in regard to the payment options and integration are completed, the Prospective Merchant is then required to execute an in-house mandatory Legal Agreement along with a comprehensive list of KYC documents (physical copy) to be provided to support the details provided by the Prospective Merchant duly authenticated and signed as true-copy by the Authorized Signatories.

Furthermore, a third party check of all Directors, Promoters, Shareholders and top management of the Prospective Merchant is conducted against government sanctioned lists, enforcement lists, credible diverse media, public court records, geography specific research, third party contributors, client requests, etc.

In addition to this, an explicit undertaking in the following format is also sought from the authorized signatories wherein the Prospective Merchant specifically provides an undertaking on the product and services being provided and payment sought through our Payment Gateway.

After all our evaluations are done, a complete application form is sent to the partner banks to release the MID’s after conducting their own Due Diligence on the Prospective Merchant as they deem fit.

Once the MID’s are received and a ‘Green Check’ is received from the Legal Affairs’, the Prospective Merchant is intimated via e-mail and their access on the dashboard is ready to be integrated on the Partner Merchant’s Website and start with its transactions the Cashlesso Way being assured of seamless service and relying on a robust Payment Gateway Platform now available to them.

If any partner merchant is found to be availing our services for a business/operation that is categorized as ‘Restricted Businesses’ and/or any product or service, which is not in compliance with all applicable laws and regulations whether federal, state, local or international including the laws of India, the partner merchant will be subject to pertinent legal proceedings and with immediate effect the services rendered to the partner merchant will be terminated.